Mastering Design Thinking at MIT

- conducting interviews/user research

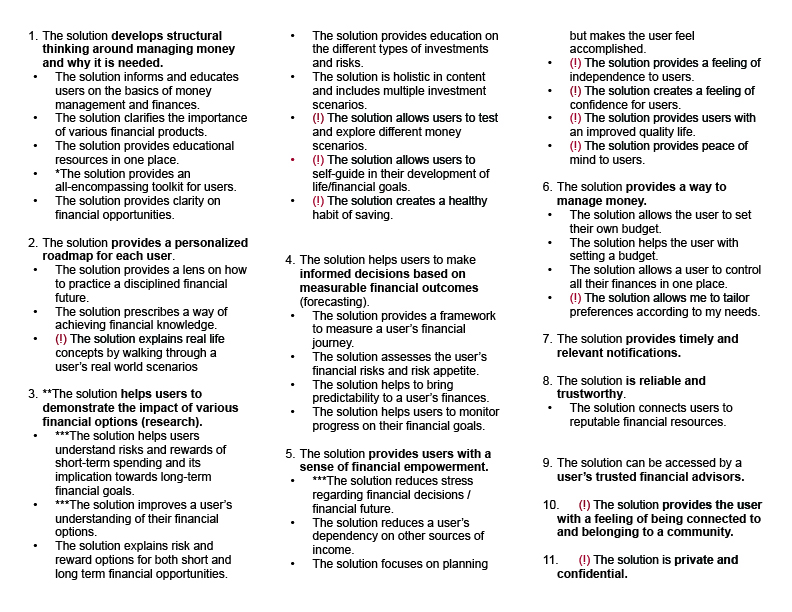

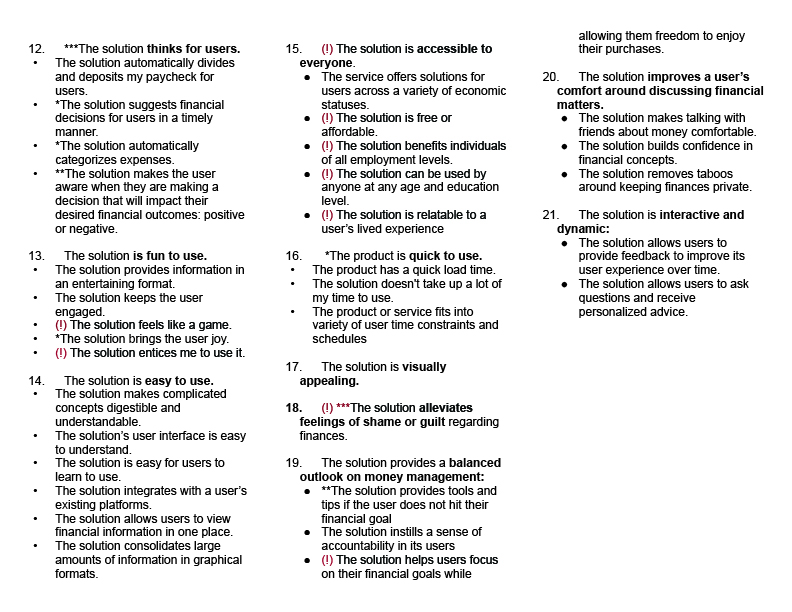

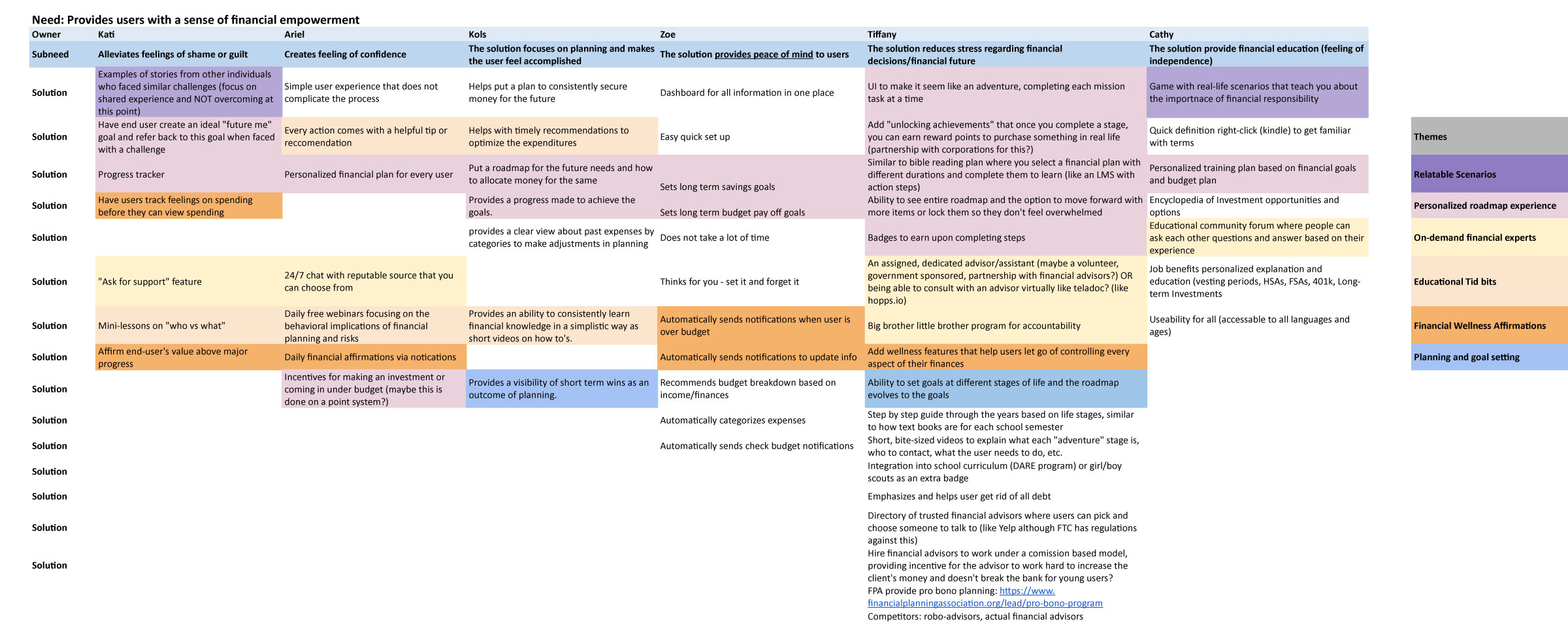

- identifying primary, secondary, and latent needs;

- creating service experience cycle and customer journey maps

- discovering real, winnable opportunities

- appling the design for environment (DFE) and life cycle assessment (LCA) principles to the product design process.

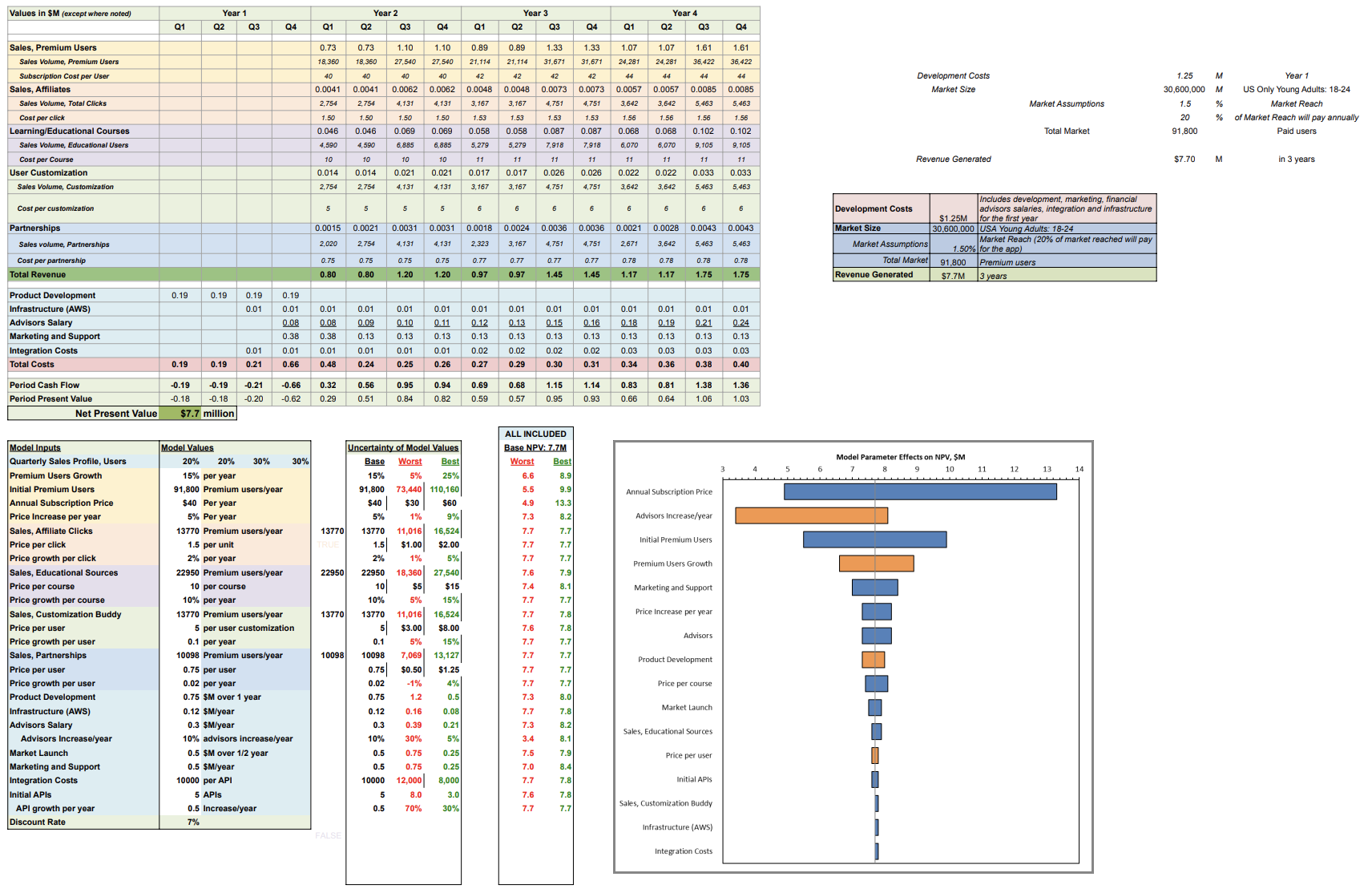

- performing competitive and financial analyses (NPV calculations)

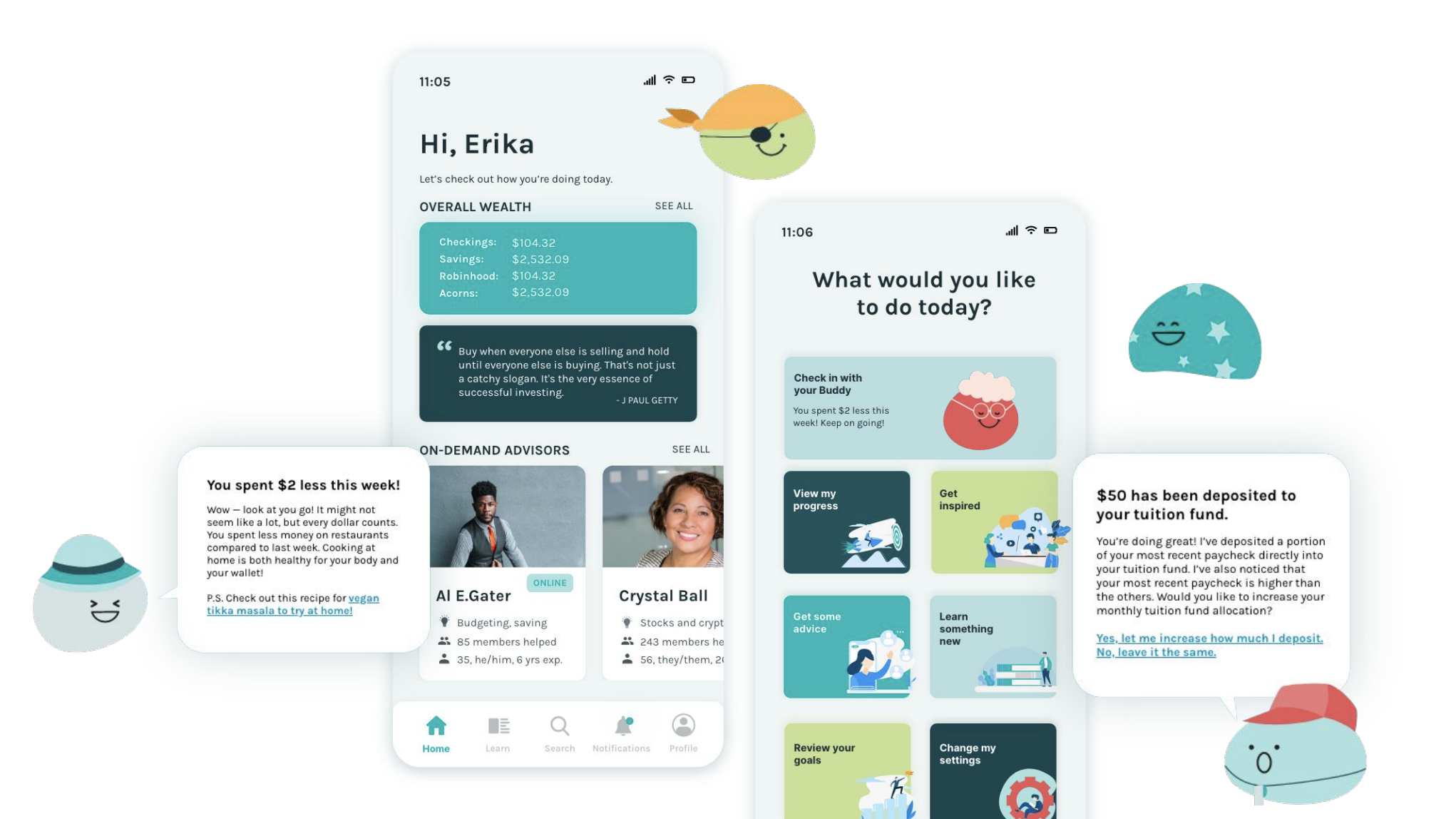

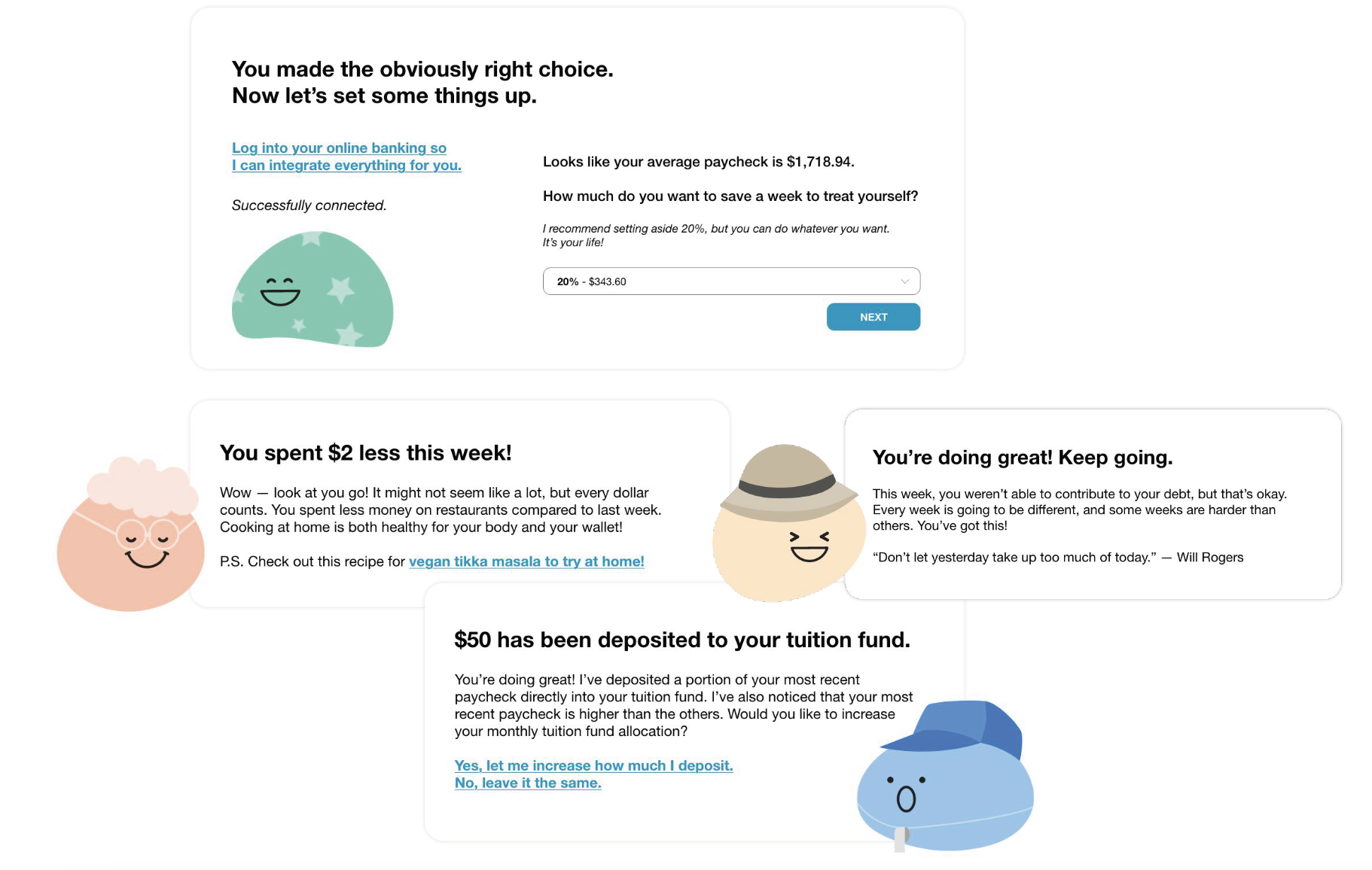

- designing a prototype of the product solution

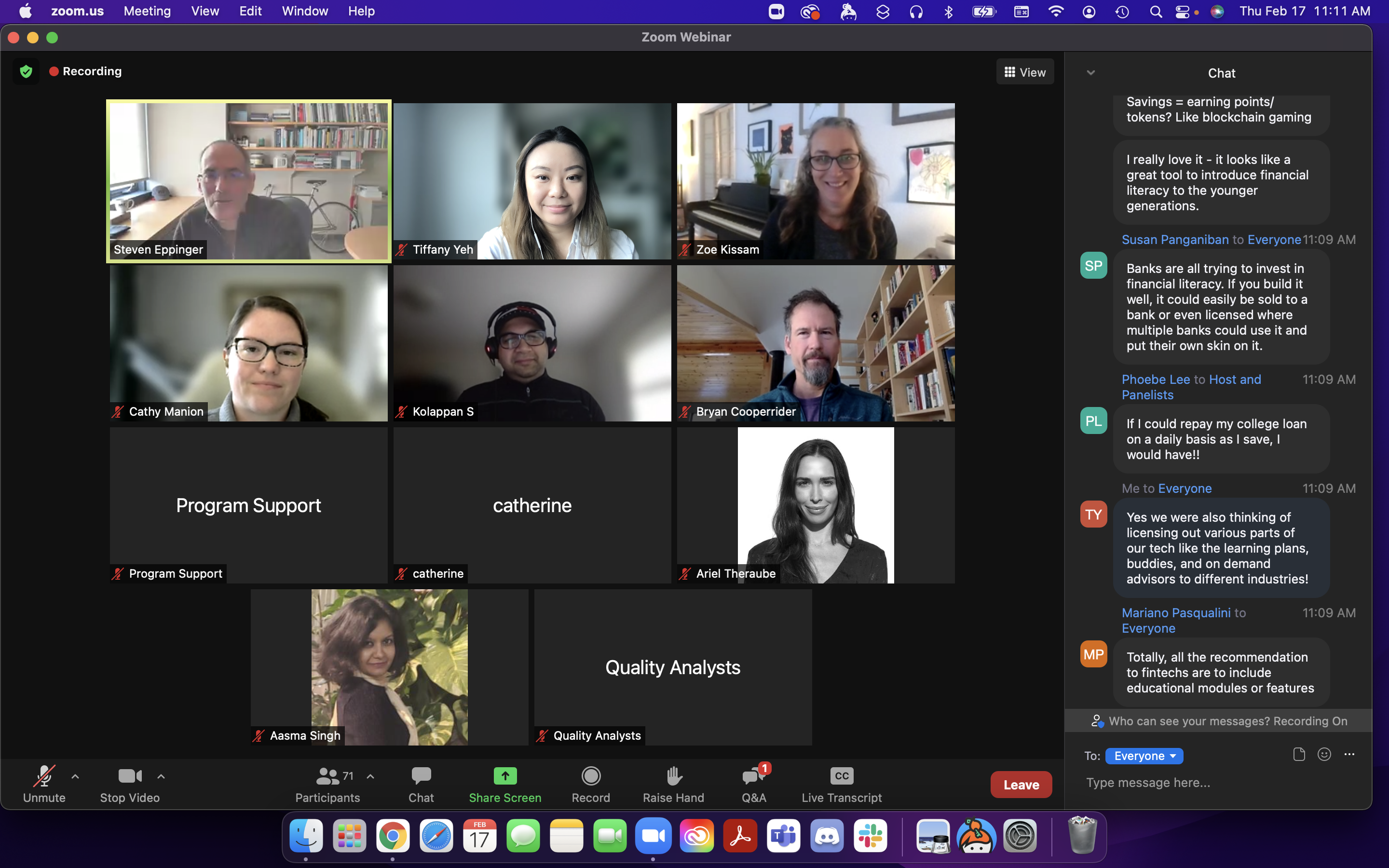

- presenting the solution to Steven Eppinger